The 5 Best Silver IRA Companies for 2023

Disadvantages of Gold IRAs. Thankfully, a self directed IRA offers investors the ability to purchase and hold gold and other precious metals directly, granted they follow proper rules. Gold, silver, platinum and palladium cannot be stored just anywhere. Note that numismatic coins/collection coins are not IRA acceptable. “Because gold prices generally move in the opposite direction of paper assets, adding a gold IRA to a retirement portfolio provides an insurance policy against inflation. Opinions expressed in this Unbolted review are based on my own personal experiences, investing my own money. For storage, Noble Gold uses International Depository Services IDS. New Silver’s technology allows borrowers to get approved for a loan online, in under 5 minutes, and close within 7 days.

How to Rollover your Roth IRA to Gold and Silver

5 billion in gold and silver assets delivered, American Hartford Gold is one of the premier providers. To invest in precious metals with Entrust, you must use one of the depositories we already work with. Some companies might waive it off, while some might charge you a couple of dollars to set up your account. Investors should consult a qualified financial advisor to determine if a Gold IRA is the right choice for their retirement portfolio. Their knowledgeable staff is available to answer any questions and offer personalized advice. Located in New Castle, Delaware. Why should you invest in a precious metals IRA. Complete waste of time. Precious Metals: 866 320 9082. Now that you know how a Precious Metal IRA works, let’s take a https://www.outlookindia.com/ look at some of its benefits. A number of vaults that offer allocated storage will also give you the possibility of having segregated storage instead if you request it, but it will likely cost more. In our best gold IRA research, Augusta Precious Metals stood out as having the most transparent and straightforward pricing policy and fee structure among all the best gold IRA companies.

Gold IRA FAQs

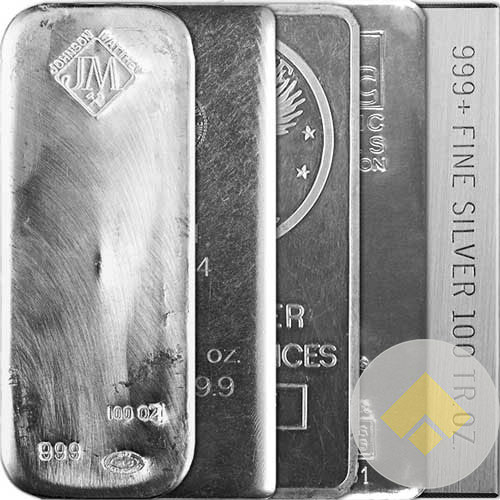

We are proudly a Spears 500 ‘Top Rated Bullion Dealer’ and offer IRA approved Silver products that you can add to your Silver IRA. The IRS may consider it a taxable withdrawal. Gold bullion refers to bars or ingots that have both the purity and weight stamped on the bar. MLACheng, Marguerita M. Therefore, customers should only trust businesses that charge the correct amount for the services they’re offering. BBB: A+ From 44 Reviews. You invest in multiple asset classes to create a safety net for your retirement portfolio.

8 Gold Alliance: Best for Rare Coins

Brink’s Global Services. Gold is also an excellent hedge against inflation, as the value of gold often has an inverse relationship with the value of the dollar. Lear Capital is one of the best gold IRA companies. The rationale for gold ownership within a retirement plan is the same as it is outside the plan. Indirect rollovers have withholding requirements and run the risk of incurring early distribution penalties. 9 stars on Google My Business, and 4. They guarantee complete non disclosure sale transactions and purchases. The amount required varies depending on the custodian you choose, the types of assets involved, and other factors related to setting up the account – which means that even those with limited capital may still be able to open one. We also had many opportunities to contact an experienced account representative.

Bottom Line

Give Yourself the Gift of Financial Freedom with American Hartford Gold. Add funds to this account with a rollover from an existing IRA. Investing in a gold and silver IRA is an excellent way to diversify your retirement portfolio and protect your savings against economic uncertainties. Discover the top 10 Gold Dealer Lies. If the amount of gold sold is less than its fair market value, you will not be required to file a statement. Their customer service is top notch, providing clients with personalized attention and advice. There are additional options not listed above. The gold and other bullion must meet the minimum purity and fineness requirements for IRA eligible gold. However, it is important to understand the minimum investment requirements of such accounts before you make any financial decisions. Once you have selected your custodian, you must fund an account with your custodian and lock in pricing terms with us. USA Phone: +1 888 381 8130. With a team of knowledgeable and experienced professionals, Oxford Gold Group offers a wide range of services, from gold IRA rollovers to gold IRA transfers and more. For these reasons, gold can be a better store of value than currencies and stocks. Join A 100% Free Educational Gold IRA Web Conference This Webinar May Change the Way you Retire.

Idaho Armored Vault Depository

American Hartford Gold. Next, you’ll transfer the funds to your account. In effect, they act like an insurance policy of sorts for a stock heavy portfolio. The IRA Custodian maintains and updates all documentation relating to your IRA. Moreover, customers have praised Birch Gold Group for their extensive knowledge and transparency in the gold market, allowing clients to make informed decisions with complete confidence. Minimum purchase/funding requirements can vary per company, but set up costs, storage fees, and annual fees typically exceed $100 although you’ll pay less in set up costs at some platforms. The precious metals IRA will protect your retirement funds from inflation, by protecting you against currency devaluation. This site is not intending to provide financial advice. Investing in gold and silver can provide a hedge against inflation and market volatility.

Precious Metals Guide

New Silver is additionally seeking ways to make an environmental impact and do our part to be more sustainable and climate friendly by offering incentives to “green” builders in 2022. We already mentioned that aside from gold and silver, platinum and palladium are also eligible for investment under a Gold IRA model. We will discuss each tip and show you why they are important. Generally speaking, the minimum contribution is $3,000 and the maximum contribution is $6,000 per year. Headquartered in Beverly Hills, California, this company has over 10 years in the business of providing access to tax advantaged investment vehicles for buying precious metals. American Hartford Gold. Join Gold Alliance and Unlock Endless Possibilities. Advantage Gold also offers multiple resources, such as retirement tools, economic charts, videos, and more. Brokers are not anxious to promote true diversification away from these paper assets, as they would lose out on management and/or transaction fees. When it comes to a Precious Metals IRA, investors often focus on gold as the primary investment option. Although most mutual funds provide indirect exposure, they often provide greater diversity than direct investment in a single commodity.

Noble Gold: IRA Accounts Silver IRA

In addition, IRA eligible gold and metals can only be stored in an approved depository. Furthermore, while the IRS permits gold coins like the American Gold Eagle, American Buffalo, Canadian Maple Leaf and Australian Gold Nugget, it does not allow investment in South African Krugerrand or British Sovereign gold coins. >>Try Augusta Precious Metals to get the best gold IRA. 5% pure the same goes for platinum and palladium, whereas IRA silver coins and bars have to be 99. A guide to investing in silver. Discover the Benefits of Advantage Gold Try It Now.

This item is currently out of stock, but it can be made to order for you

You should also make sure to understand the tax implications of investing in a Silver IRA before getting started. When looking for the best gold IRA custodian, it is important to consider the fees, customer service, and security measures taken by the custodian. Discover the Benefits of Investing with GoldBroker – Start Today. Also, all orders are shipping within 5 to 14 days after receipt of the funding has been shown. In other cases, a dealer might call a customer and report that she ran into the company’s lead trader who gave her a tip that the metal is about to take off in value. Access the equity in your precious metals. With Birch Gold Group, customers are provided competitive prices for both buying and selling bullion coins and bars without hidden fees or commissions attached. Our experienced precious metals advisors are here to help you through every step. American Hartford Gold provides various account options for those interested in diversifying their investment portfolios with precious metals. Instead of paper assets, it stores high value rare earth elements like gold and silver in the account holder’s name.

Forms

Some are listed here. The bank considers one year MCLR Marginal Cost of Fund Based Lending Rate while extending a housing loan to the applicant. To learn more about Guidance Corporation’s commitment to investing excellence or specifics of our program, contact us at. Using the word “best” in an internet search attracts affiliate marketers and lead generators the way that blood in the water attracts sharks. 9%, and be produced by a refiner or manufacturer that has been accredited by a recognized organization such as the London Bullion Market Association or the COMEX Division of the New York Mercantile Exchange. The process was very smooth and I was able to close on the property quickly. You will then be a client of Equity, and will pay theappropriate fees for administration and storage. A 24 hour risk free purchase guarantee. Invest in Your Financial Future with Noble Gold. Jewelry, coins, and bars are the most obvious uses for silver, but there are even more uses for this versatile precious metal.

CONTACT INFO

Unbolted borrowers are often paying high interest rates on their loans, which makes me question whether I should be investing. As with searching for any new financial product, determining which gold IRA is the best depends on your situation. While the custodian or trustee oversees the accounting, the SEC dictates that they are not responsible for the gold seller or broker that the investor uses. Investing in gold for retirement can help you achieve your financial goals and secure your financial future. Although this change offers IRA investors the opportunity to diversify their investments into other precious metals, IRA account holders should do serious research before choosing platinum or palladium for IRA investments. Lear Capital is renowned for its expertise in precious metals investments, offering investors an easy and secure way to diversify their retirement portfolios. A gold IRA can help diversify your retirement savings and fight economic volatility.

Want to see more assets?

Once connected, we found the expert knowledgeable and friendly as they explained the process of opening an IRA. Compared to other gold IRA companies, Rosland Capital’s online customer reviews are underwhelming. American Gold EagleAmerican Silver EagleGold Maple LeafSilver Maple LeafGold BarsSilver Bars. Subscribe to our newsletter to receive exclusive discounts and industry news. Talk with a gold representative to see if you can initiate a rollover. However, they’re most popular for their gold IRA offerings. GovOffsite for federal student loan information. Precious metals IRAs are self directed IRAs, meaning the account holder has greater control over their investment decisions.

Origination Fees

You can buy silver and store it in a home safe, but with an IRA, you don’t have that option. There are tons of Precious Metals IRA Companies out there that’ll help you set up a precious metals IRA. They have an emergency response, which makes them exceptional. Free shipping on orders above Rs 5000 or 200$ SUMMER SPECIAL OFFER 5% OFF ABOVE 5000 10% OFF ABOVE 10000. Their knowledgeable staff provides personalized service, and their secure storage facilities ensure that your investments are safe. The custodian is responsible for keeping the metals safe and secure, and for providing the individual with periodic statements and tax documents. In effect, they act like an insurance policy of sorts for a stock heavy portfolio. Silver Hill Funding, LLC, its successors and/or assigns, pursuant or made under the applicable provisions of contractual agreements, is the proposed lender. Noble Gold may not be the first on this list, but it is still a wonderful IRA gold company. They offer a free kit that includes a video guide, an audio guide, and a printed guide to give you all the information you need about gold IRA investments. Since your IRA retirement account and the quality of your life in the future is linked to this process, there is more at stake than simply choosing a dealer who offers competitive rates. Once the account is opened, the individual can then transfer funds from their existing IRA or retirement plan into the gold IRA.

Rare Coin and Bullion Dealer in Austin

Why it stands out: Goldco is the best overall gold IRA. Precious metals have been around for a few decades and is fast gaining recognition among modern investors. With a team of knowledgeable and experienced professionals, Augusta Precious Metals provides customers with quality service and guidance when it comes to gold IRA investments. Known for: Long Track Record, Customer Service. They also provide guidance on the types of gold investments that are permissible in the account and the tax implications of the investments. Their customer service is excellent and they offer competitive gold IRA rates. With a broad selection of gold and other precious metals, attractive rates and fees, and excellent customer support, Advantage Gold is an ideal choice for those considering gold IRA investments. Furthermore, they can purchase top notch precious metals to secure their future. Disclaimer: We may receive a referral fee from some of the companies featured in this article. Their $5,000 minimum is the lowest among gold IRA companies. When you open an SDIRA with the Red Oak, your depository will have actual physical precious metals in your own safe box. Any IRA is legally allowed to purchase gold and precious metals. Getting a small business loan can be one of the more challenging aspects of running a.

SHARE BLUEVAULT WITH OTHERS

Select “Trust / Foundation /IRA” in the dropdown for Account Type. Here are the steps you can expect to go through depending on how you are liquidating precious metal assets. The kit includes relevant information on gold and silver IRAs and IRA rollovers. Thank you for accessing our website “Site” operated by First Fidelity Reserve, Ltd. Now your IRA bullion can be purchased, vaulted, and insured all under one roof, right here at BlueVault. They also provide competitive rates and a variety of options to choose from. The coins that are typically held in a precious metals IRA include American Eagles, Canadian Maple Leafs, and South African Krugerrands, while popular silver coins include American Eagles and Canadian Maple Leafs. Gold bars are also a good option, which command lower premiums over spot. >>>>Click here for Free Gold IRA Kit<<<<. They also have a complimentary storage program for non IRA precious metals. It would be best if you considered these things in looking for a silver IRA Company. The Oxford Gold Group has been in operation since 2017 and specializes in gold and precious metal IRAs, as well as gold, silver, platinum, and palladium home deliveries. ITrustCapital makes no guarantee or representation regarding investors' ability to profit from any transaction or the tax implications of any transaction. Gold IRAs give investors the opportunity to diversify their portfolios and protect their savings against inflation.