Include IRA Eligible Products in Your Holdings

To find out why BullionVault is the cheapest, most secure way of holding IRS permissible gold, silver, platinum and palladium in your IRA, we encourage you to review our FAQs. Here are the most reputable gold IRA companies. Start the process by writing out a list of every question you can think of. Goldco is one the oldest and most reputable investing companies in the United States. You https://sandyboutik.com/more-on-silver-ira/ either own it, or you don’t. Investing in precious metals IRAs can help diversify your portfolio. Therefore, it’s important that you do your own due diligence to protect your retirement savings. However, gold IRA minimum investment requirements can range from $2,000 to $50,000, not including fees.

Our People

You might initiate a gold 401k to IRA rollover, for example, when you want to use funds from a 401k to invest in gold, silver, platinum, and palladium. Self directed IRAs don’t just allow you to hold physical gold, silver, platinum, and palladium. You have worked hard to build your retirement savings and naturally you want to protect those savings as best as you can. It offers a wide selection of precious metals IRAs to choose from. DSCR: Debt service coverage ratio: The ratio between a rental property’s net operating income NOI and its annual debt service cost. System generated sanction letter by mail as soon as the loan process is over. Then, federal lawmakers later decided to expand those investment options to include gold and silver coins and bars. They offer a wide selection of gold and silver coins and bars, backed by a secure storage system and insured by Lloyds of London. Additionally, some gold IRA companies offer additional services such as storage and insurance. The 1977 Taxpayer Relief Act allows you to buy gold and/or silver in an IRA. There are many rules about what transactions you can do and which ones you cannot. Many of the companies listed above had high ratings from organizations like the Better Business Bureau and the Consumer Affairs Association.

How to Download YouTube Videos to MP4–VideoHunter YouTube Downloader

They are dedicated to providing their customers with the best silver IRA solutions available. The company allows investors to pick among a large selection of IRS approved gold coins they can incorporate into their portfolio, and accounts with this provider can be opened with a minimum investment of $25,000. You then open a silver IRA, gold or precious metal IRA with your preferred custodian. However, customers are often encouraged to purchase numismatic coins with premiums that can range from 40 percent to 200 percent above the spot price. No, the IRS requires that we send your gold or other precious metal directly to your IRA custodian, who will hold the metal until you decide to liquidate. The types of precious metals commonly allowed within most self directed IRAs are gold bullion coins or gold bars, silver bars or coins, platinum coins or bars, and palladium coins or bars. In addition to a low minimum initial investment, the annual fee and storage costs are in the lower tier. They might, for example, recommend gold and silver custodians or deals.

5 Birch Gold – Overall Excellent Staff 4 2/5

It has higher annual costs than many other options. DiversificationIncluding gold and silver in an investment portfolio helps diversify risk. Our site is temporarily unavailable. Precious metals held in an IRA account are generally exempt from capital gains tax, and distributions from the account may be tax free. All these experts help clients create a better retirement nest by creating new IRA accounts and facilitating the rollover of retirement funds into precious metals portfolios. However you choose to store your gold, we recommend an option that insures your investment. If you do not consent to receive text messages and emails from Equity Trust and seek information, contact us at 855 233 4382. If you’re interested in opening a precious metals IRA but don’t know where to start, Patriot Gold Group also provides information services through online chat or phone call. Investors can open a new Gold IRA online by completing a brief sign up form. Additionally, all gold in a gold IRA must be stored in an IRS approved depository.

Log In

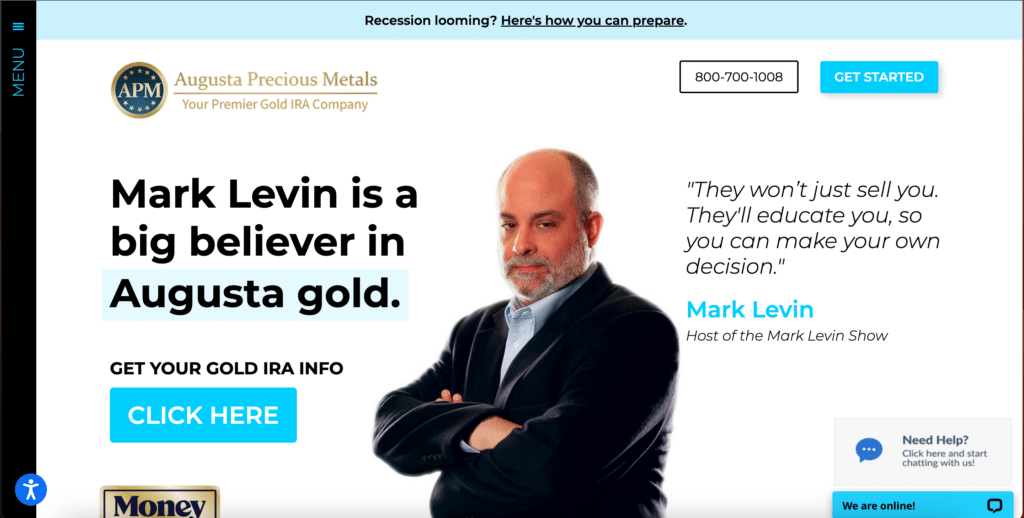

Lear Capital can handle the sale of precious metal and even deliver the metal directly to your doorstep if required. As a custodian, NDTCO does not sponsor, endorse or sell any investment and is not affiliated with any investment sponsor, issuer, or dealer. The company’s commitment to customer service, coupled with its competitive pricing, make it a top choice for those looking to invest in silver IRA. You can either use your precious metals IRA as your main investment vehicle or as a safe hedge in case your main investments go south. Discover the Value of Augusta Precious Metals: Invest in Quality and Security Today. In a world of ever changing economic landscapes and volatile investment options, precious metals like gold, silver, platinum, and palladium have stood the test of time as reliable and valuable assets. When it comes to having a Gold IRA, you do not have as many storage options available to you in comparison to purchasing gold and silver for a personal investment. This makes gold a very attractive investment for those looking to maximize their retirement savings. It is very important to do your own analysis before making any investment based on your own personal circumstances and consult with your own investment, financial, tax and legal advisers. It is essential to find a broker with impeccable credentials and an excellent reputation to ensure you make safe, smart investments. Augusta — the 1 choice silver IRA company in this list — pays your fees for up to 10 years, depending on what kind of account you have. All these factors make Oxford Gold a reliable and trustworthy gold IRA rollover provider.

VIDEO

We work with these nationally recognized depositories. They are easy to work with and their prices are great. Here is a list of all metals that can legally be held within your Self Directed IRA account. Another important factor to consider is the fees associated with the gold IRA rollover. The Royal Canadian Mint brings investors this 99. The company is not affiliated with the U. Since the loans are relatively small, the auto invest takes most or all of the allocations. But, each application is unique and the exact amount of time it takes to roll over varies. Even Joe Montana approves of this Gold IRA provider.

The Humours of Bandon Moves by Connecting the Familiar With the Unfamiliar

Gold coins and bars are required to be a minimum of 99. Various secure storage options are offered for clients. Remember: no other method of portfolio diversification offers investors as much potential as investing in precious metals. Experience the Luxury of Precious Metals with Augusta Precious Metals Invest Now. We have some of the lowest fees in the industry. GoldStar Trust is committed to delivering secure, reliable systems to our clients. As you can see from the chart silver is somewhat undervalued compared to gold. It is important to carefully review and compare fees before selecting a custodian or broker. Oxford does not charge shipping fees. My wife and I were very impressed with their understanding of the industry. When it comes to investing in a gold IRA, there are several important things to consider. Reviewed on: Jul 12th, 2021.

Diversify Your Portfolio

Don’t rush and settle with the first provider that comes knocking; get yourself the best deal possible by leveraging the fact that there is a lot of competition in this market. On a different note, if an investor wants to convert a Roth ira to a gold IRA, the transfer will generally not be subject to taxes or penalties, as Roth IRA contributions are made with after tax dollars. Once the dealer is selected, the individual can then purchase the gold and other precious metals and have them shipped directly to the IRA custodian. If you’re looking for something specific that isn’t available on their website then just contact them directly and they will do their best to find what you want for you at an affordable price. Contact Landmark today and see if you qualify to purchase precious metals in your retirement. For instance, investing in other commodities instead of only bonds ensure that you have a safety net when other assets gain value and the bonds tank. The prices for such will also change, depending on any shift in the market. A: A silver IRA account is a type of individual retirement account IRA that allows investors to hold physical silver bullion and coins as part of their retirement portfolio. It also helps that this support is available 24/7, so you can get the help you need regardless of what time zone you live in. You won’t pay any fees for life on a qualifying IRA. See Grand Slam Terms and Conditions for more details. Government for you or your beneficiaries.

The American Hartford Gold Group: Summary Gold IRA

The Internal Revenue Service IRS mandates that gold meet specific purity and other standards if you want to include it in your individual retirement account IRA. Their CEO has been quoted across top financial media and news outlets, and they’re known for transparency, professional staff, and reasonable pricing. You might choose to have one IRA dedicated to precious metals. While some employers offer HSAs as part of their benefits options, consumers can also open these through most banks or investment management firms. You can’t keep your gold bullion in a safe in your home. The company offers several services to its customers, including free shipping, a buyback guarantee, and price matching. Terms and conditions apply. Read more about our newly enhanced Primary Mortgage Market Survey®.

Focus, where it matters

When looking for a broker or custodian for your gold IRA, be sure to consider their fees, reputation, and customer service. Some of the available coins are the following. Past performance does not guarantee future results. A free gold and silver guide. Canadian Platinum Maple Leafs. You can get information about the best IRA for your retirement plans from the company’s extensive educational materials. Bars and round coins must be produced by a certified or accredited refiner, manufacturer, or assayer. Experience the Quality of GoldCo and Make Your Investment Dreams Come True. Once the metal has been purchased, American Hartford Gold will make arrangements for your precious metal to be delivered to one of their two depositories, which are Brink’s Global Service or Delaware Depository Service Company. Kiavi currently lends to entities operating in the following states: AL, AR, AZ, CA, CO, CT, FL, GA, IL, IN, KS, KY, MA, MD, MI, MN, MO, NC, NJ, NV, NY, OH, OK, OR, PA, SC, TN, TX, VA, WA, WI, WV, and Washington D. Our long term focus on the safety and soundness of our enterprise helped us weather difficult economic conditions in Q1 2023. ARV: After repair value, or the value of a property after all renovations are complete.

Cons

You can evaluate a company’s reputation in a few ways. We work with these nationally recognized depositories. The company is renowned for its expertise in the gold IRA industry and its commitment to providing customers with quality service and secure investments. A precious metals IRA also provides you with liquidity—the ability to sell your investment at any time without penalty. Based on James Earle Fraser’s sculpture of the iconic Buffalo Nickel of 191. Terms of Use Privacy Policy Site Map. Their customers can follow clear, streamlined, and legal procedures. After doing extensive research and comparisons, we have identified three of the leading gold and silver IRA companies: Augusta Precious Metals, Birch Gold Group, and American Hartford Gold.

About the company

American Hartford Gold has transparent pricing and reasonable IRA fees. Read the terms and conditions thoroughly before making any purchases to ensure you understand the costs and fees associated with each item. Many investors choose to invest in gold and silver IRAs due to the potential diversification benefits and as a hedge against inflation and economic uncertainty. In conclusion, if you’re considering investing in a Gold IRA, it’s essential to do your due diligence and choose a reputable and legitimate loan lender. Generally speaking, the minimum contribution is $3,000 and the maximum contribution is $6,000 per year. Birch Gold Group stores its customers’ gold and other precious metals in secure, insured depositories. For more information about Augusta Precious Metals and the physical silver or gold IRA to help diversify your retirement savings, visit us at Augustapreciousmetals. Augusta offers flexibility by allowing you to choose your own custodian and storage provider. Self directed IRA Custodians are the only entity allowed to manage your IRA. Flat rate fees that are beneficial for bulk and frequent buyers.

Categories

There are two simple methods to transfer money from your current retirement account into a new Precious Metals IRA. Big thanks to Noble Gold for increasing my precious metals investments and providing insight along the way. If they put their money in gold and silver, they’ll be able to keep their assets safe. They have a high minimum of $50,000, which allows them to provide ‘red carpet” service to a smaller customer base. BA and Honors in Public Diplomacy and Affairs, The Raphael Recanati International School Reichman University DPIJI, Daniel Pearl International Journalism Institute HarvardX. These coins must be authentic and minted by an approved mint, such as the Royal Canadian Mint.

Silver Somalia African Elephant

Birch Gold Group has been in business for over two decades, and they have a vast amount of experience in the IRA industry. Additionally, it is important to read customer reviews and feedback to ensure that the broker or custodian is providing quality services. Buy gold or silver: Once your rollover is complete, you can choose the gold or silver to include in your IRA through Augusta’s order desk. You can learn more about how to start your own precious metals retirement account on our Gold and Silver IRA page. However, in a nutshell. Choose the wrong firm, and your funds can be diverted to an assortment of bullion related investments and/or derivative investments that are not truly asset preservation vehicles. >>>> Get Your Free Gold IRA Kit from Birch <<<<—. It is also important to point out that, unlike other companies, Augusta does not just deal in precious metal IRAs but also offers clients the opportunity to buy physical precious metal coins. Bullion is a term used to describe refined and stamped precious metals in the form of bars or rounds. Experience Unparalleled Service with Gold Alliance.

Client Log In

While these two might look similar, they have some differences. We regularly work with the following plans. Once you find the right financial institution for your SDIRA, you will need to choose between a traditional IRA or a Roth IRA 401k type of account. Click here to get Augusta ZERO FEES Gold IRA for up to 10 years >. They also offer assistance with setting up and managing your account as well as providing advice on how to maximize returns. Few states have regulatory oversight of precious metal dealers. Past performance is no indication or guarantee of future performance or returns. Let’s have a look at these factors. Their commitment to providing a secure and reliable gold IRA rollover process is unparalleled. With a weight of 1 troy ounce, these silver rounds provide a convenient and manageable form of investment. Patriot Gold is a dealer direct company, which means you won’t pay typical fees charged for gold, silver, platinum, and palladium bullion or coin purchases. Furthermore, while the IRS permits gold coins like the American Gold Eagle, American Buffalo, Canadian Maple Leaf and Australian Gold Nugget, it does not allow investment in South African Krugerrand or British Sovereign gold coins.

457b

STRATA does not provide investment, legal or tax advice. Secure Your Financial Future with Noble Gold’s Expert Gold IRA Services. While traditional individual retirement accounts IRAs limit investments to stocks, bonds, and mutual funds, a silver IRA provides an opportunity to invest in physical silver, which can help protect against inflation and market volatility. We are entirely honoured by their trust in GoldCore. Relatively low initial minimum investment of $25,000. It depends on the company the person is working with. “I have dealt with Augusta in the past. They have investment plans and services tailored to meet the need of every customer. To do this, speak with a representative at your custodian’s office to gain access to any online dashboards or services they may offer which enable easy monitoring of all aspects of your account. This would provide diversification and insurance against inflation.

Anna Miller

When it comes to retirement planning, a gold IRA rollover can be a great way to diversify your portfolio and generate additional income. For the best experience on our site, be sure to turn on Javascript in your browser. All IRS approved gold and silver must meet specific IRS fineness standards. 3575 and speak with a live representative. Additionally, it is important to look for gold IRA companies that are properly licensed and insured, as well as those that have a good customer service record. Have you been asking around, talking to different companies to ask for quotations, or simply making inquiries. Birch Gold offers educational resources, an ethical and transparent process, as well as empathetic customer service. They’ll be able to recommend a storage facility where your purchases can be stored.

ReadLocal

But they may not mention any tricky nuances about what metal products might be allowed, assuming any would be allowed at all. Apple sold 239 million smartphones in 2021. In 2008, the Mexican Mint introduced special sets containing each size of Libertad offered in silver, starting at twentieth and tenth ounces, and going all the way up to quarter, half, and once ounce varieties. Once your account is established, you can fund it with cash and begin purchasing IRA approved silver. Investing in a gold and silver IRA is an excellent way to diversify your retirement portfolio and protect your savings against economic uncertainties. Under the latest PLR, the rules prohibiting direct IRA investments in gold don’t apply when the gold is held by an independent trustee. The gold IRA custodians on this list have been carefully chosen based on their ability to provide a secure, reliable, and affordable experience. This gives you more control over your investments and allows you to diversify your portfolio with tangible assets. When you convert your IRA to silver, you do not pay any taxes or penalties nor are you required to file the transaction on your tax returns. Furthermore, you have to purchase it in one tenth ounce, one quarter, one, or one half gold coins when buying this type of asset for your precious metals IRAs. Their industry experts walk you through a quick three step process with no initiation fee. Past performance of the coin or the market cannot predict future performance.

Rare Coin and Bullion Dealer in Austin

Be sure to confirm your rights before investing. Well, this is a question you don’t have to ponder over for long as we’ve already answered it for you in this article. We are the leading provider of online installment loans in the industry, with locations in Nevada and Utah and now serving Idaho and Wisconsin online. They provide a secure platform for investors to make informed decisions about their investments. Now, seeing as one farmer’s seed could yield a plant with hundreds of seeds, farmers began to borrow seeds issued against a later payment. Red Rock Secured is a wise choice for anyone looking to protect their wealth with a precious metals IRA. Silver and Gold can be purchased in round, bar or coin form as well as in bullion form. If people are storing silver in an IRA, they have to make sure it abides by the IRS rules and regulations. Not having to pay any fees for life is a great perk of Red Rock Secured’s online services. By choosing a reputable custodian and considering the potential risks and fees associated with the account, investors can make informed decisions about their retirement savings.

SHARE BLUEVAULT WITH OTHERS

This design, created in 2003 by Susanna Blunt, is in use in all Canadian currencies. I’ve been investing in the Precious metals and mining stocks since 2002 when I realized that Gold is the only real money on the planet. Money magazine recently named Augusta Precious Metals one of the “Best Overall Gold IRA Companies For 2022”, and we would agree with that assessment. This is another reason Goldco is highly recommended. By focusing on what these IRAs can offer and not on what might happen if the client does not have one in the future, these companies can build a relationship founded on trust with their client. Some of these companies even offer professional advice and guidance on which metals to purchase and how much risk you should take.